Common Cents Blog

Your monthly dose of practical, everyday financial advice.

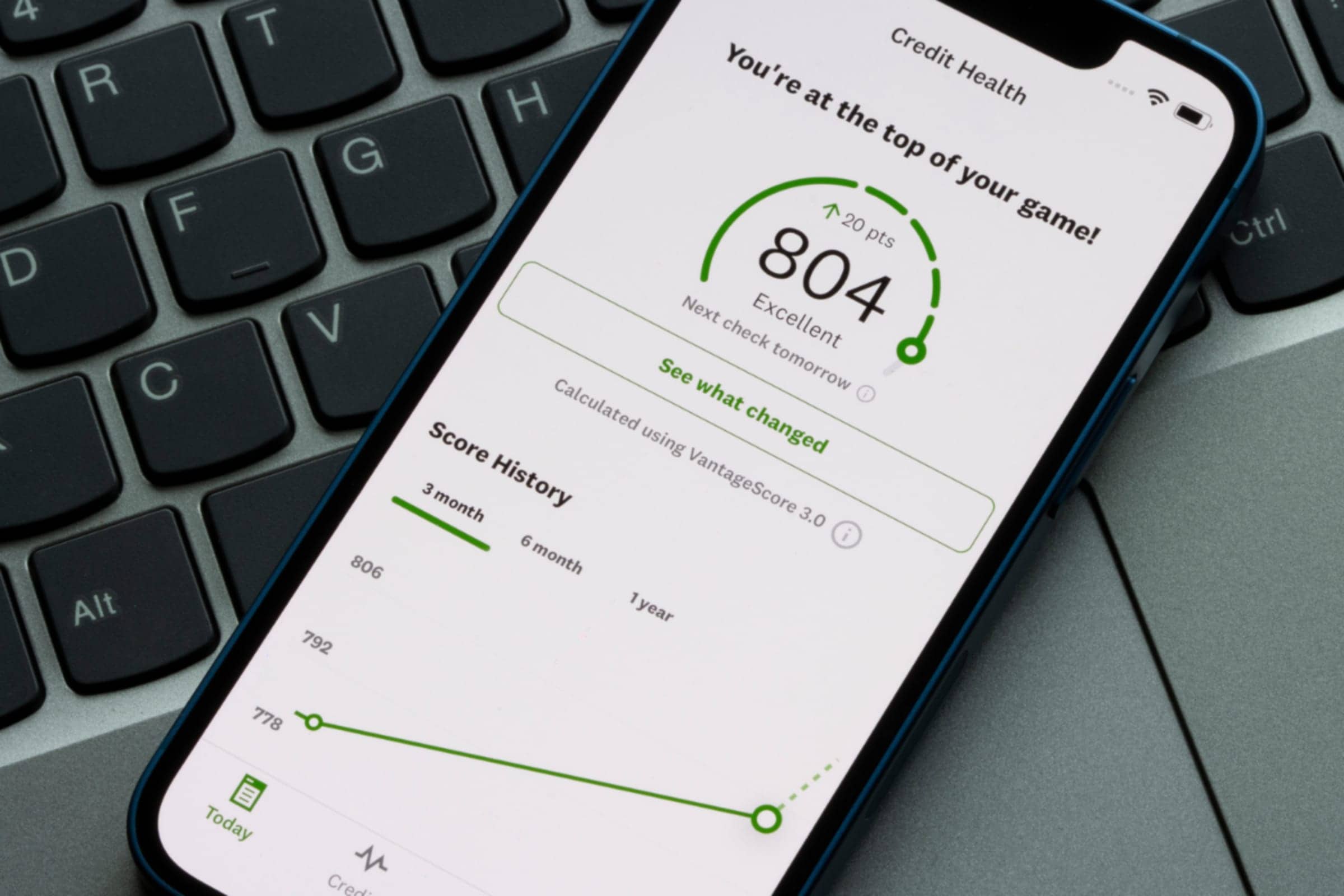

Rebuilding Your Relationship With Your Credit

Whether you’re applying for a mortgage, a car loan, or even a new credit card, lenders look at your credit score to gauge your financial health. A higher credit score can unlock better interest rates and loan terms, saving you money in the long run.

3 Ways to Make Christmas More Manageable Starting Now

The holiday season is one of the most magical times of the year. But, it often brings with it a lot of stress and difficulty when it comes to planning – and affording – how you’re going to handle gifts this year.

The Benefits of Homeownership

To buy or not to buy, that is the question. And while this question is often asked, it’s not always the easiest to answer.

CBLA’s 5 Best Mobile Banking Features

For those times you can’t stop into your local branch, we’ve made sure that you can bring Community Bank with you wherever you go.